blog: earning on binance

earn with stacking

Stacking = keeping your liquids in your wallet = on an exchange like binance this means the liquids stay on the exchange and they want to give you some interests for doing that. There are several sorts of stacking I am doing at the moment, I will explain it to you example per example.

You can stack in a flexible savingsaccount, but also put away and lock your liquids. You can invest in a pair of coins and earn on every swap there will be made in that pool with the flexible liquid swap or even invest in projects like DeFi stacking or in a launchpool. Read more below!

One stacking option gives more benefits than the other, depending on the locking up or not and investing in projects that can become worthless.

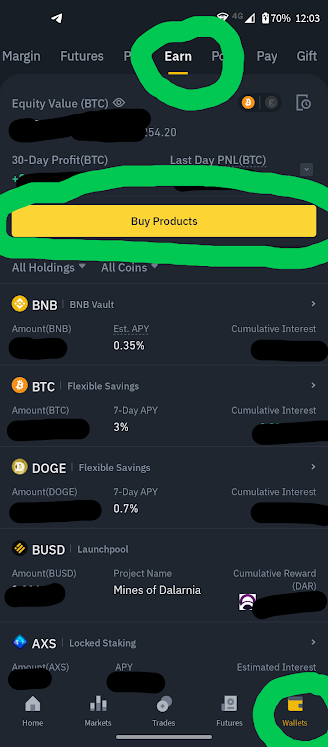

How to start? Click in your wallet in the top menu on earn. On the screen you'll see coins already stacking like I do. If you want to stack other coins, click on the yellow button buy products and keep on reading further below on my website.

earn with flexible stacking

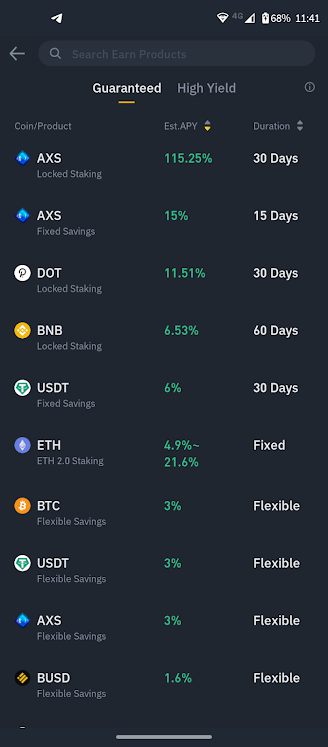

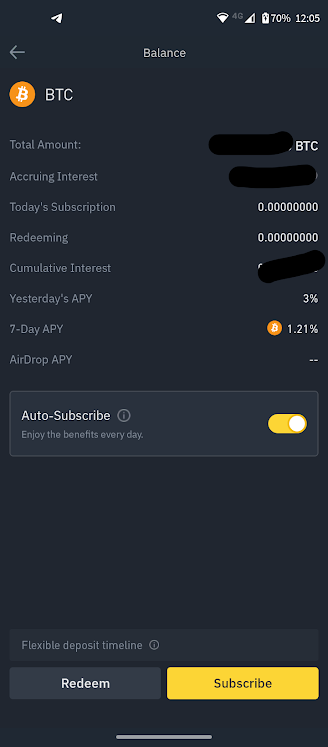

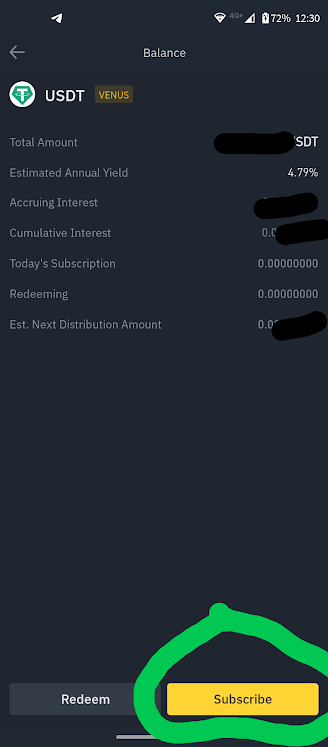

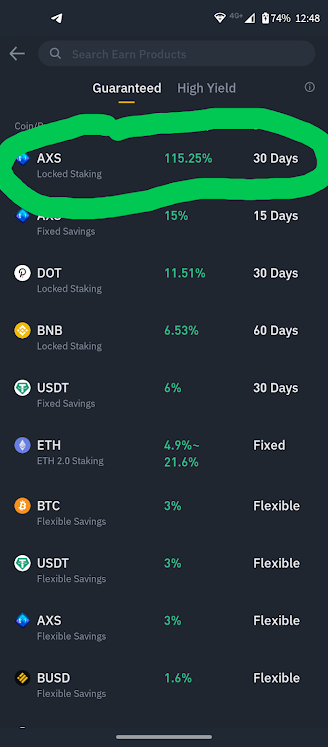

When you click on the button buy products the first screen you'll see is the garanteed offers of stacking your money or coins in. For me these offers are safe! When you choose to add some liquids to a flexible stacking offer, for example BTC flexible savings at 3%, your desired amount of bitcoins will be stacked in a savings account, and for every day these bitcoins stay in that savings account, you will get credited interests: 3% on annual base (not 3% every day ofcourse)

3% is not that much, but some coins are higher; even 0,5% is higher than European banks give at the moment: they give us only 0,11% after one year! In this flexible savings you will get

more interests on a daily base so you don't need to lock your liquids too long: every day you don't want yo use them, let them in those flexible savings account and you'll get your interests!

There is also an option for some coins that the interests are subscribed to this flexible savings accounts, so your amount gets higher and also the interests on that!

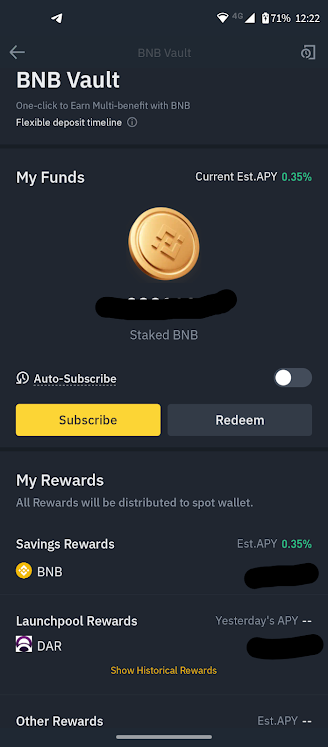

BNB Vault is the same as a flexible savingsaccount; another name for the same product. Using this vault will give you not only 0,35% interest in BNB but also sometimes new coins mined in the world, like Dalarnia in my example. So for the BNB I am flexible stacking in this Vault, I will get daily interests and new coins DAR, all added to my spot-wallet.

Your money is making money without doing a thing and always available for trading if you want to.

earn with locked stacking

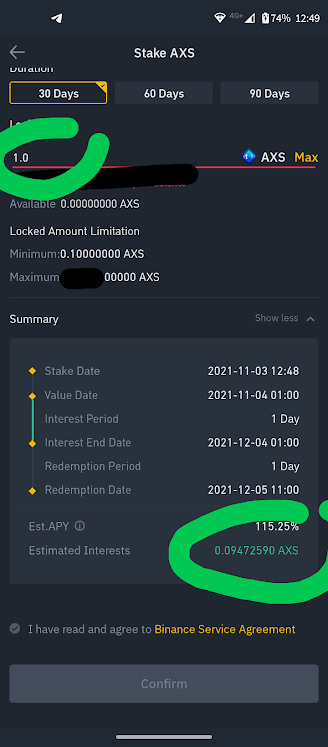

You may want to be seduced for the higher interests locked stacking provides? In my example I locked up some AXS coins for a period of 30 days at an interest of 115,25%

This means after subscription I can't get my coins back for the next 30 days, but after the 31st day I will get my coins back and an interest of 115,25% on annual base (so multiply

your coins with 1,1525, divide it to 365 days and multiply again with 30 days = those coins you will get extra).

Example: 100 euro investing in AXS for 30 days, you will have like 110 euro after 30 days if the price doesn't change on the markets.

= This kind of investing is dangerous, because you can't access you locked liquids in the locked period, so when price is collapsing meanwhile, you can't sell the coins during

that period and if the price is worthless in the end, worst scenario ever, you are nothing with the 10 euro extra in AXS coins.

But like I said, this is the worst scenario ever and in cryptoland you need to be patient sometimes for higher prices and that's okay!

115,25% is the highest I saw on binance on locked stacking, other coins I should give a try provide 25% on annual base, what's a lot more than the 0,11% you bank is giving!

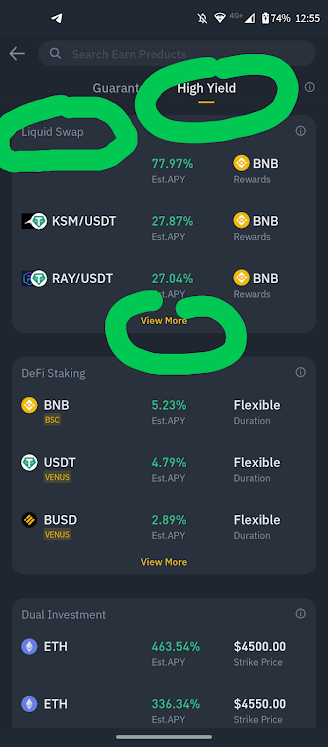

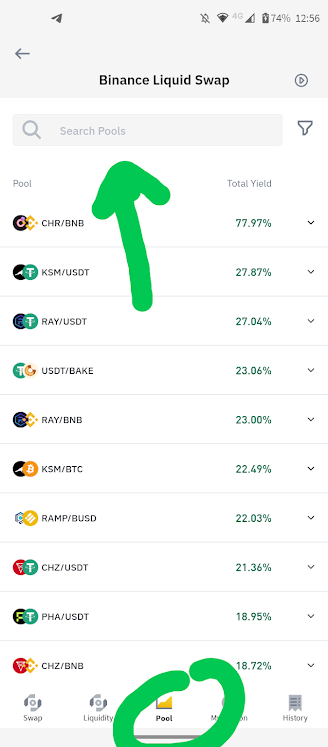

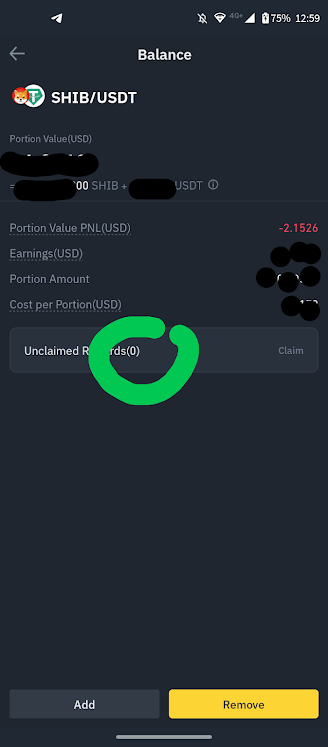

earn with liquid swap

A new earning way I am exploring. On the earning-tab you choose for the High Yield option. You'll see the three highest suggestions of liquid swap (and DeFi stacking and Dual Investment). When you click on view more, you can search for a desired pool where you want to put some liquids in.

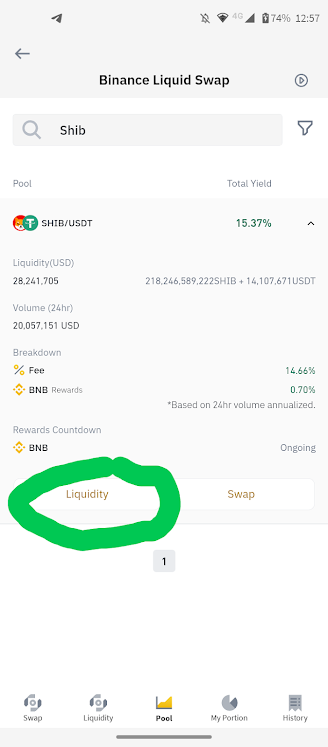

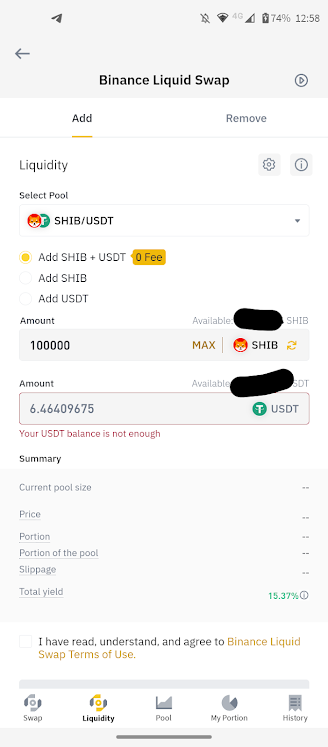

Example: i search for the pool SHIB/USDT, choose for the liquid option. Investing without fee, you should have both liquids available: when you have enough of both SHIB

and USDT coins, you can add these liquids in the liquid pool without any fee; also withrawing both liquids is without any fee.

You'll see how many USDT coins you need when you want to add 100 000 SHIB coins: 6,46.. USDT coins.

Now you will get hourly interests, they accumulate so no need to claim them hourly, once a day or a week if enough. You will get the interests from the earnings in the pool where other visitors are swapping SHIB into USDT coins and in reverse. When you swap coins, you need to pay a fee, and a portion of those earnings, SHIB and USDT, come to your spot-wallet.

It's fun and addictive to see every hour earnings coming your way! But why is it dangerous and a High Yield: like you saw for a certain amount of SHIB there is a corresponding amount of USDT. There is a percentage between both coins in one pool. When these percentages change (because of the swapping more in one direction, of the price of the coins) the computer automatically changes the percentage of both coins in the pool and also your invested percentage of coins will change: example 100 000 SHIB can change to 99 995 SHIB and the 6,46 USDT will change to 6,47 USDT. Some can find the changing an advantage, others a disadvantage and a losing of money.